Renters Insurance in and around Indianapolis

Indianapolis renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Indianapolis

- Beech Grove

- Greenwood

- Franklin Township

- Marion County

- Johnson County

- Hamilton County

- Boone County

- Fountain Square

- Speedway

- Carmel

- Zionsville

- Fishers

- Noblesville

- Brownsburg

- Avon

- Broad Ripple

- Southport

- Bargersville

- Whiteland

- Meridian Hills

- Lawrence

- Home Place

- Cumberland

There’s No Place Like Home

No matter what you're considering as you rent a home - number of bedrooms, internet access, price, townhome or house - getting the right insurance can be essential in the event of the unpredictable.

Indianapolis renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Open The Door To Renters Insurance With State Farm

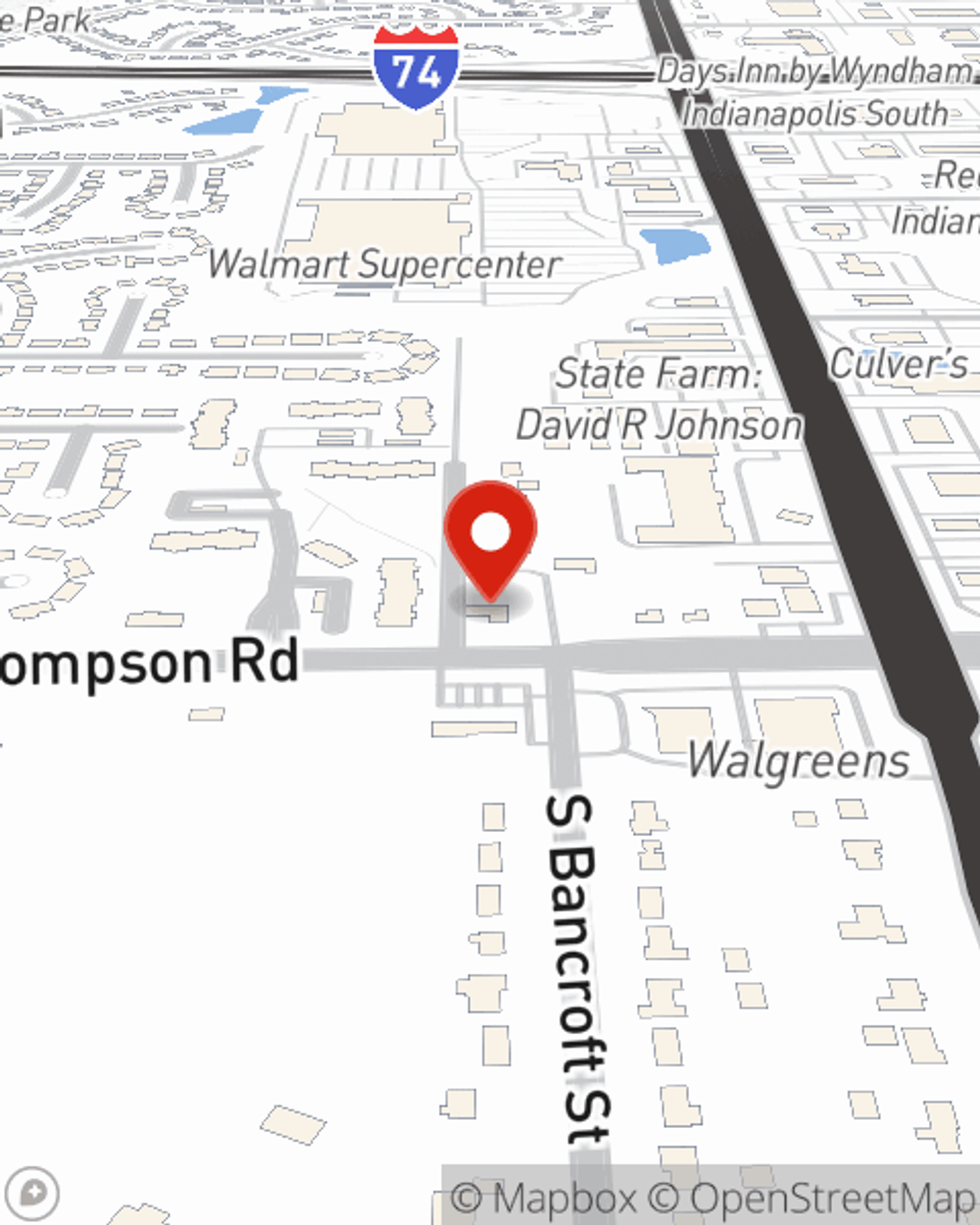

When the unpredicted abrupt water damage happens to your rented townhome or apartment, often it affects your personal belongings, such as an entertainment system, a video game system or a tool set. That's where your renters insurance comes in. State Farm agent John Elbin has the knowledge needed to help you choose the right policy so that you can keep your things safe.

It's always a good idea to be prepared. Reach out to State Farm agent John Elbin for help getting started on savings options for your rented unit.

Have More Questions About Renters Insurance?

Call John at (317) 851-9353 or visit our FAQ page.

Simple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

Simple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.